company income tax rate 2019 malaysia

Furthermore in many cases the tax liability can be met by the notificationreporting procedure. The 2018 labour productivity of Malaysia was measured at Int55360 per worker the third highest in ASEAN.

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

The statutory Swiss WHT rate of 35 is levied but refunded provided that the respective earnings are declared as income for tax purposes.

. According to the Global Competitiveness Report 2021 the Malaysian economy is the 25th most competitive country economy in the world. The economy of Malaysia is the third largest in Southeast Asia and the 34th largest in the world in terms of GDP. Between Swiss group companies Swiss WHT of 35 is usually fully refundable.

Individual Income Taxes Urban Institute

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Malaysian Tax Issues For Expats Activpayroll

Laos To Implement New Income Tax Rates

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Income Tax Malaysia 2018 Mypf My

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

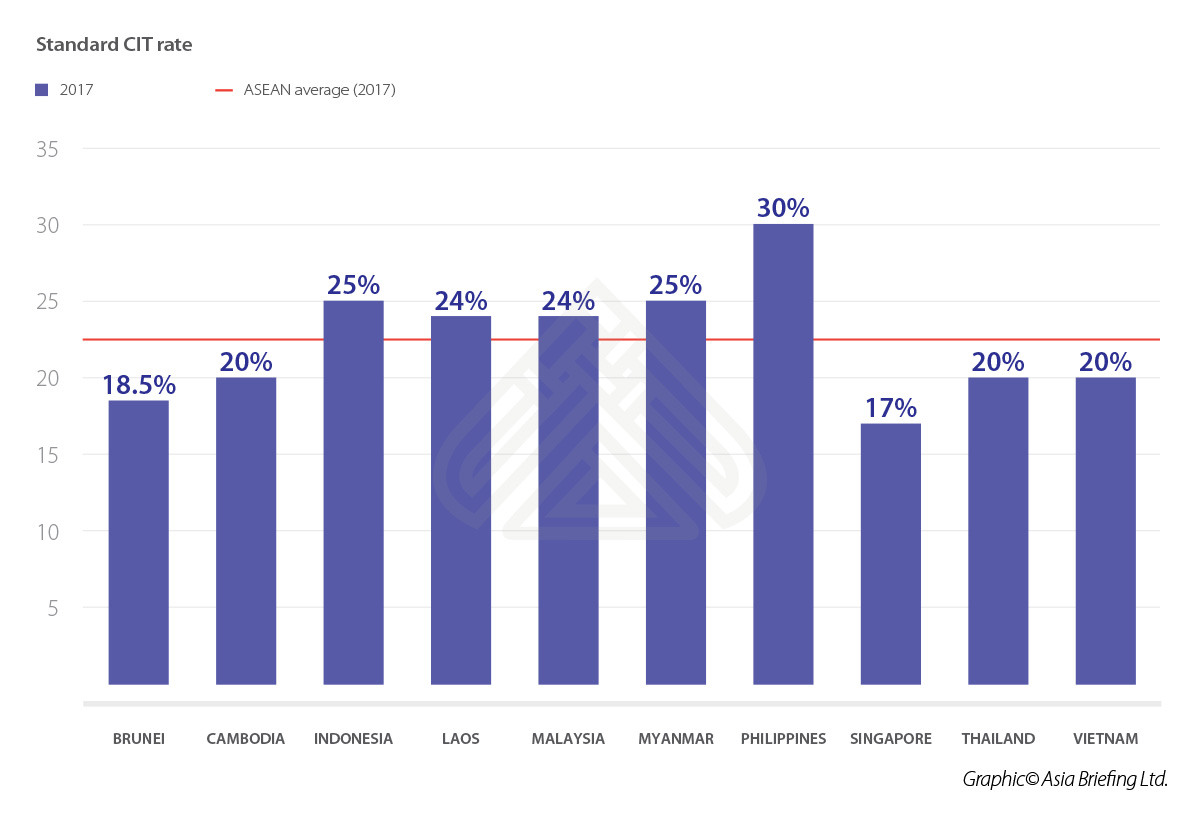

Comparing Tax Rates Across Asean Asean Business News

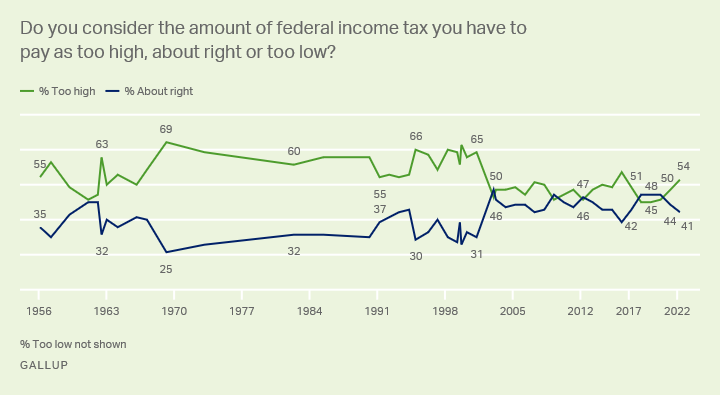

Taxes Gallup Historical Trends

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

2020 E Commerce Payments Trends Report Malaysia Country Insights

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Global Minimum Tax An Easy Fix Kpmg Global

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Comparing Tax Rates Across Asean Asean Business News

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

0 Response to "company income tax rate 2019 malaysia"

Post a Comment